Facing a pivotal decision about your residence? Do you embrace the enticing world of ownership or settle on the flexibility of {renting? The choice between selling and renting is a deeply individual one, influenced by a multitude of factors spanning your economic prospects, lifestyle needs, and long-term goals.

- Carefully analyze your present financial standing. Can you manage the costs associated with buying a house? Factor in mortgage payments, property taxes, insurance, and potential maintenance costs.

- Pinpoint your lifestyle. Do you value the permanence of owning a home, or do you lean toward the flexibility that renting offers?

- Evaluate your long-term goals. Are you expecting to stay in the same area for an extended duration? Owning a home can be a valuable asset over the long haul, but it's not always the best choice for everyone.

Finally, the sell vs. rent dilemma is a deeply unique one with no easy answers. By thoughtfully weighing your choices and analyzing your individual requirements, you can make an informed decision that supports your long-term goals and brings you satisfaction.

Own or Rent? Weighing the Benefits and Drawbacks

Deciding whether to own or lease a home is a significant monetary judgment. Both options present unique advantages and disadvantages. Owning provides stability, allowing you to personalize your environment according to your preferences. However, it also demands a substantial down expense and ongoing charges, such as debt servicing and property taxes.

{Leasing|, on the other hand, offersflexibility, permitting you to change locations more easily. Lease payments are generally lower than loan repayments. However, renters forgo the opportunity to build equity and may face restrictions regarding modifications to the property.

- Elements to evaluate include your budgetary constraints, routine, and aspirations

Is it Time to Sell or Become a Landlord?

Standing at a crossroads with your property can be tricky. The decision of whether to cash out or become a property owner is a weighty one, filled with potential gains and risks. Carefully weigh your personal aspirations, financial situation, and willingness to invest before making this pivotal choice.

- Consider the current real estate market: Is it a buyer's or seller's market? Research recent activity in your area to gauge potential value appreciation.

- Evaluate your financial situation: Can you comfortably afford the expenses associated with being a landlord, including property repair, insurance, and potential vacancies?

- Assess your lifestyle preferences: Are you prepared to handle tenant concerns?

Ultimately, the best decision depends on your individual circumstances. Consulting with a financial advisor or real estate professional can provide valuable guidance as you navigate this important choice.

Is Owning a Home Worth It in Today's Market?

Deciding between investing a home is a major financial choice that impacts your future. While equity in your house can be appealing, yielding returns from subletting your dwelling might present a more attractive scenario. Let's the pros and cons of each route to discover if renting is the right solution for you.

- Purchasing a Property can offer tax advantages, but it also comes with responsibilities.

- Temporary Housing provides mobility and often minimal investment.

Ultimately, Thoroughly evaluate your circumstances to make an sound decision.

Assessing Your Alternatives: Selling vs. Renting Out Your Property

Deciding if to utilize your property can be a tricky task. Selling offers a quick lump sum, allowing you to pursue new goals. Conversely, leasing provides a reliable cash flow while retaining ownership. Factors such as your current needs, the local economy, and your risk tolerance all play a crucial role in shaping the best course of action for you.

- Carefully examine both selling and renting options, considering associated expenses like commissions, taxes, maintenance, and vacancy rates.

- Consult with real estate professionals, financial advisors, and legal experts to gain informed perspectives.

- Develop a comprehensive plan that aligns with your financial goals

Strive The Landlord Life: A Realistic Look at Renting Out Your House

Thinking about becoming a landlord? It's Best real estate agent in Fort Lauderdale a decision that can bring passive income, but it also comes with its own set of challenges. Before you post your property on online boards, take a good look at the truths of being a landlord.

- Firstly, you'll need to navigate legal requirements like tenant screening, lease agreements, and local housing regulations.

- Secondly, be prepared for the responsibilities that come with owning rental property. This can include handling maintenance requests, dealing with issues from tenants, and collecting rent on time.

- Above all, remember that being a landlord demands patience, communication skills, and a willingness to resolve conflicts.

Renting out your house can be a good way to boost your income, but it's important to go into it with your eyes wide open.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Rick Moranis Then & Now!

Rick Moranis Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Andrew McCarthy Then & Now!

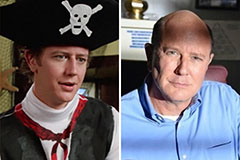

Andrew McCarthy Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!